We all want to work smarter, not harder. In real estate, the way we work hasn’t seen much change before this decade, but now it seems like things are changing at a breakneck speed. Remote Online Notarization, blockchain technology, and artificial intelligence are all buzzwords trending for the past few years, but what are some tangible ways to harness these changes in technology for the real estate transaction?

What are some procedural changes that might help improve your internal process and increase your quality of work?

Here are some of the latest ways the industry is addressing inefficiencies affecting consumers, lenders, real estate agents, and title agents.

Ways to increase your title company’s efficiency:

- Implement MISMO Closing Instructions (Now available here!)

- Adopt eClosing Solutions

- Improve customer service with automation and AI

Want more real estate and title industry insights? Sign up to receive weekly updates!

Implement MISMO Closing Instructions

Standardization of real estate transactions across the country is key to collecting, storing and transmitting accurate data between lenders and title agents. The Mortgage Industry Standards Maintenance Organization has been working with the American Land Title Association, independent title agencies, underwriters, law firms, and software vendors to create universal guidelines that will improve communications between these parties.

In the past, MISMO has attempted to improve communications between lenders, title agents, Realtors, and consumers by creating a standard nomenclature with the UCD regulation.

This second attempt at standardization takes a slightly different approach. Instead of focusing on naming conventions with the closing instructions, this new workgroup pinpointed that focusing on the closing instructions’ content (what should be included) and the organization of that content may yield higher adoption.

The Two MISMO Closing Instruction Templates:

- Master (General) Closing Instructions Template – explaining the Lender’s typical closing requirements and instructions that don’t change from one transaction to the next. Such Master Closing Instructions may be released by Lenders semi-annually or annually instead of at every transaction.

- Transaction (Specific) Closing Instructions Template – explains the instructions and pertinent information to a single, specific closing transaction. This is to be provided with every transaction.

These two templates are designed to work in tandem and benefit both the settlement agents and the lenders.

How do the MISMO Closing Instructions help Title Agents?

Improving communication between lenders is an important part of improving workflow efficiency, delivering higher accuracy when preparing and executing financed closings, and increasing the quality of service. Both forms provide agents with consistent and reliable information, so there is no need to search through files only to find the answer to your question is missing.

The Closing Instructions make it easier to locate the pertinent information faster, leading to a faster and better experience for the homebuyer.

You can read more and download the new MISMO Closing Instructions Templates here. These Templates are still in the working stages, but it’s always a good idea to stay ahead of the curve and evaluate if implementing these solutions is right for your title company or law firm.

Adopt eClosing Solutions

Chances are that you’ve already begun to integrate some of these digital closing solutions into your title production. If not, it’s a good time to consider implementing these now or as soon as it becomes available in your area.

- eRecording – thousands of documents are being eRecorded a day through title agents’ software integration with companies like Simplifile and eRecording Partners Network. This solution helps to reduce rejection rates and improve recording time. Not every county allows eRecording, but over 1,900 municipalities currently do. This equates to about 80% of the country’s population living in a jurisdiction with eRecording.

- eSignature – Even if you don’t live and work in one of the states that allow for Remote Online Notarization (RON), the Uniform Electronic Transactions Act (UETA) makes it possible to gather electronic signatures on documents that don’t require notarization. Sending these documents for buyers and sellers to review and sign before meeting at the closing table is one way to increase your title company or law firm’s efficiency. It also gives consumers more time and under less pressure to understand the documents they are signing.

- eNotarization and RON – The UETA also authorizes notaries to electronically notarize documents that are eSigned in front of them (not remotely) and established if a document is notarized according to the laws of one state, that notarial act must be recognized as valid in another state, so you don’t necessarily have to wait for your state to pass explicit laws on RON before adopting the technology. Theoretically, you can have a notary from Virginia (RON approved) notarize closing documents for a transaction in Alabama (no RON approval). The hitch comes if you’re in a county that doesn’t accept eRecording, which may result in a clerk rejecting the documents.

If you’re worried about skirting state laws, chances are that Remote Online Notarization laws will soon be passed in your state. Additionally, you’ll have to be sure to get your underwriter’s approval.

Even still, your company might not need to worry too much about the remote piece just yet. According to a recent study by Solidifi, 70% of consumers would like a more digital process at the closing table, but 81% would still prefer to close in person. This means that no matter how much technology is introduced into the closing process, the closing agent and real estate attorney play an integral role.

Those who offer hybrid closings are best positioned to meet these customer’s expectations.

Improve Customer Service with Automation and AI

Finding the right file in your closing software to answer a question from a Realtor about an upcoming transaction can take time. Some buyers may prefer to chat on your website regarding general questions. Lenders want to know that communications containing private data are transmitted securely.

One way that title agents can accomplish all this is by introducing AI-powered chatbots like Alanna. This is a virtual closing assistant designed specifically for title companies. Alanna answers questions via SMS text or webchat. The program integrates with your closing software to retrieve documents securely over a secure channel and answer specific questions like “Who is my closer?” or “How do I deliver my deposit money?” These questions can be asked and answered instantly at any time.

Leveraging automation options that work with your title production is a great way to let your closers and processors focus on more complex tasks and improve efficiency and customer service.

Some people will prefer to call and speak directly to their closer, but what matters most is that you are giving your clients more options.

Other aspects of the real estate industry have been using the power of AI and machine learning to help consumers during their home search, so it makes sense for the title industry to accommodate homebuyers and Realtors in the same way.

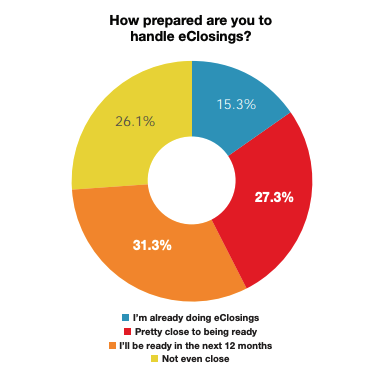

Source: Voice of the Title Agent

If you feel like your title company is lagging behind, you’re not the only one. In the 2019 edition of The Voice of the Title Agent, 26.1% of respondents said they are “not even close” to being prepared for an eClosing and 31.3% said they anticipate being ready in the next 12 months.

Change is difficult, but without it, there can’t be any growth. If you’re in the 26%, now is the time to evaluate your options for ways to introduce technology and procedures that will increase your title company’s efficiency.