One of the most frustrating things about working in the title industry is having to reopen a file that has been filed away after closing because an issue arises. This can happen every once in a while when another agent working on a new deal involving a property you previously closed realizes a satisfaction was not properly recorded months or years after your closing.

Worse, it comes up during an underwriter or lender audit that reveals the satisfaction, sometimes called the cancellation, release, or re-conveyance, was never properly recorded. In order to prevent such an issue, release tracking is an important part of post-closing due diligence for every settlement agent to adopt.

Consumers, investors, and regulators are demanding more transparency about the service providers that work with lenders in the real estate, title, and mortgage settlement industries. As a result, organizations like the American Land Title Association (ALTA) have developed guidance to empower title companies and real estate law firms to create documented policies and procedures for Best Practices.

While the best practices put forth by ALTA are completely voluntary, it’s a valuable guideline to ensure that title companies and real estate law firms are meeting the expectations of lenders, underwriters, and state and federal regulators during audits.

See why lien release tracking is so important. Download this guide!

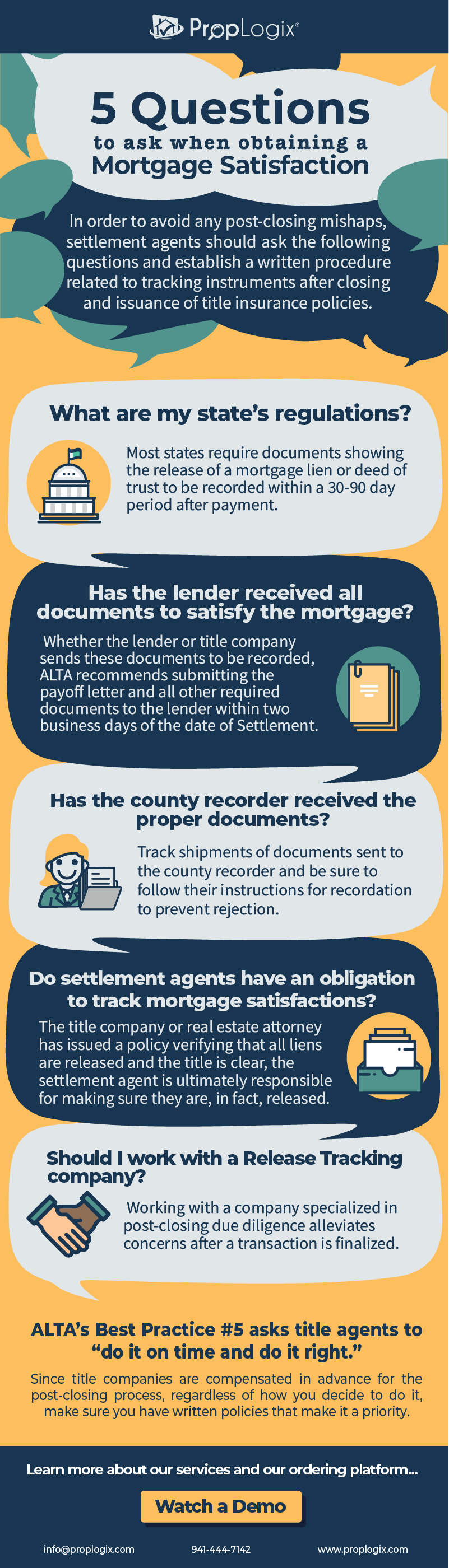

In order to avoid any post-closing mishaps, title agents should follow ALTA’s BEST PRACTICE #4:

“Adopt standard real estate settlement procedures and policies that help ensure compliance with Federal and State Consumer Financial Laws as applicable to the Settlement process.“

Settlement agents should ask these questions to meet this Best Practice for post-closing recording:

- What are my state’s regulations?

- Has the lender received all documents to satisfy the mortgage?

- Has the county clerk-recorder received the proper documents?

- Do title agents have an obligation to track mortgage satisfactions?

- Should I work with a lien release tracking company?

If you’re a homebuyer or seller, you can find the steps to obtaining a mortgage lien release here.

1. What are my state’s regulations?

The first question to ask yourself is the most obvious. What are the state and federal regulations when a mortgage satisfaction must be recorded?

Consolidation and reselling of mortgage loans has become problematic for title companies and real estate law firms trying to obtain a timely recording of mortgage releases, creating frustrations for property owners who need a clear title to complete a real estate transaction. In order to mitigate the problem of post-closing documents that are missed and cause issues for homeowners in the future, the Uniform Residential Mortgage Satisfaction Act (URMSA) was created.

The URMSA states a document must be recorded within 30 days after the mortgage is fully paid or the secured creditor may be held liable for any actual damages incurred by the mortgagor. If the satisfaction is not recorded within that time, there is an additional 30 day grace period to record the satisfaction if the mortgagor (or the title insurer, attorney, lender, or another agent of the mortgagor) sends a demand by any method with proof of receipt. If the satisfaction isn’t recorded within a minimum of 60 days, they may incur penalties and be held liable for damages and attorney’s fees.

Some states don’t have provisions requiring a creditor to release a fully paid debt, but many of those state statutes provide that if they fail to do so within 60 days of full payment, a title agent or real estate attorney may record an affidavit on behalf of the mortgagor which releases the lien described in the affidavit.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

2. Has the lender received all documents to satisfy the mortgage?

Review the legal and contractual requirements to determine if your company or another entity, such as the lender, has the obligation to send these documents to the county recorder and incorporate such requirements in your written procedures.

If it falls to the lender to send these documents, increasing communication with them will increase action on their part. Do they need additional documentation from you before they send the request to the recorder the subsequent documents?

According to URMSA, “ a secured creditor shall submit for recording a satisfaction of a security instrument within 30 days after the creditor receives full payment or performance of the secured obligation.”

Of course, with the growing number of private lenders and lien holders, some may be unaware of their duty to send the documents required to release the instrument. Additionally, a major consequence of the secondary mortgage market is that the current mortgage holder is rarely the same as the one who provided the property owner the original loan. Sometimes a lender may mail the satisfaction back to the settlement agent or the mortgagor. When this happens many homebuyers and homeowners are unaware of the final step to officially release the mortgage lien. They’ll file away the letter with other important documents inadvertently creating a cloud on the title.

Whether the lender or title company sends these documents to be recorded, ALTA recommends submitting the payoff letter and all other required documents to the lender within two business days of the date of settlement.

If the title company is responsible for sending the recording package to the Land Records Office or County Clerk, be sure to ask yourself the next question.

3. Has the recorder received the proper documents?

There is a domino effect in the real estate industry. As home sales remain steady, so do the stacks of paperwork. Many municipalities and county recorders in charge of recording the subsequent release, satisfaction, termination, etc. are sometimes behind due to the influx of closings.

Track shipments of the documents sent for recording and respond quickly to any recording rejections. Addressing rejected recordings will prevent any unnecessary delays.

In order to prevent rejection, some key things to remember when sending documents to the county clerk include:

- The correct fee is attached.

- The quality of the document is good and the text is legible.

- State documentary fees are included

- Deeds contain a valid grantee address

- Sufficient margins are provided

- Checks are signed

- Checks are payable to the proper recording authority

- Notary seals are darkened

- Instructions for the order of recording are included

- Return addresses are provided

- Package tracking barcodes don’t interfere with the authority’s recording barcode

- Documents are submitted to the correct county

If you aren’t the one who shipped the documents, be sure to set a reminder to check the land records at the end of 30 days. If they aren’t recorded by that time, follow up with the lender and county to see what may have happened, whether the documents were never sent, sent to the mortgagor by mistake, or if there was a rejection. If necessary, an affidavit may need to be filed on behalf of the mortgagor.

4. Do title agents have an obligation to track mortgage satisfactions?

This is a contentious topic among professionals in the title industry. Since the purchaser (whether the homeowner or lender) has obtained title insurance, they are protected whether a previous lien is properly released or not. Under ALTA’s Best Practice #4, title agents are recommended to review legal and contractual requirements to determine if they are obligated to record post-closing documents. However, since the title company or real estate attorney issues a policy verifying that all liens are released and the title is clear, the title agent is ultimately responsible for making sure they are, in fact, released.

Another ALTA Best Practice, #5: Adopt and maintain written procedures related to title policy production, delivery, reporting, and premium remittance, underscore an expectation from lenders to receive the new policy from the most recent transaction within 30 days while imposing no restriction on themselves to execute releases of instruments in the title commitment. It suggests title agents should “issue and deliver policies within thirty days of the later of (i) the date of settlement, or (ii) the date that the terms and conditions of title insurance commitment are satisfied.”

Section (ii) seems to create an uncomfortable catch-22 for agents who wish to abide by these Best Practices by providing the policy within 30 days of settlement, but are beholden to lenders who may not file the release, satisfaction, or cancellation of the mortgage before 30 days. Lenders want their policy within 30 days whether you track all instruments’ subsequent recordings or not. While Section (ii) seems to provide an extension to issue a policy and place a burden on lenders to perform their obligation in a timely manner, this initiative is being driven by lenders and they are unlikely to impose greater expectations on themselves than what is set in state regulations.

This creates a gray area for many title agents questioning if it’s their responsibility to follow up with the prior mortgage and when they should issue a policy. This best practice doesn’t discourage the practice of release tracking, but it does often create added pressure on agents to issue policies before a lender has a statutory obligation to record releases. If you decide to wait for satisfactions before issuing the final policy, this will require a change in your current post-closing procedures. You may also find it impossible to meet a lender’s expectations.

5. Should I work with a release tracking vendor?

Many title companies and law firms have post-closing departments that have clearly documented processes for ensuring the instruments in the title commitment are recorded properly, including the mortgage satisfaction. But of course, tracking instruments to ensure they are recorded isn’t the only responsibility for a post-closer. Smaller companies without this department may find it difficult to keep up with all the tasks after closing like tracking all instruments. And, of course, many title agents may operate under the assumption that others in the real estate transaction are fulfilling their obligations.

Working with a company that specializes in release tracking will

- Guarantee that all instruments are recorded

- Provide resolution services for instruments that aren’t recorded according to state statutes

- Save on time and internal costs when resolving post-closing issues

- Add peace of mind that all title policies are issued without a cloud

- Improve audits and relationships with your lenders and underwriters

- Protect consumers from future issues when they sell their home

ALTA’s Best Practice #5 asks title agents to “do it on time and do it right.” Since title companies are compensated in advance for the post-closing process, regardless of how you decide to do it, make sure you have written policies that make it a priority. Doing it right the first time and tracking all instruments in the title commitment after closing will mean fewer headaches for you down the road and help build trust with your underwriters, lenders, and consumers.