Real estate professionals know that there are often gaps in homebuyers’ education. Many consumers learn as they go and rely heavily on their real estate agent or attorney for guidance. One area of the real estate transaction that we know doesn’t get enough attention is title insurance and what that means for a homeowner’s property rights.

Just as no two transactions are identical as problems arise that are unique to each property and must be addressed to get the clear to close, no two title commitments are exactly the same. That’s why it’s so important for homebuyers to understand the basics so there aren’t any surprises after closing.

Here are the basics to know about a title commitment.

What is a title commitment?

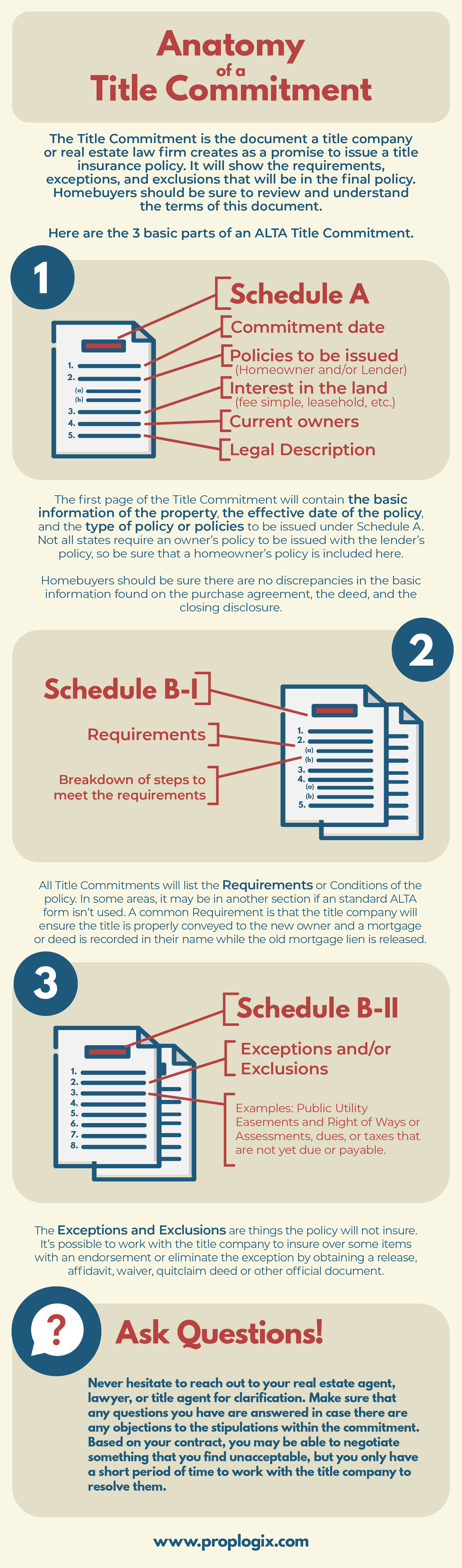

The title commitment is the document a title company or real estate law firm creates as a promise to issue a title insurance policy. It’s basically a road map that the title agent uses to cure any defects in order to transfer the title free and clear.

A title commitment might also be called a preliminary title report or a binder depending on where you live.

Unlike other forms of insurance that protect against unforeseen future calamities, title insurance is all about eliminating risk prior to insuring, and it’s purchased with a one-time premium instead of monthly installments. The title agent, underwriter, or third-party vendor conducts a title search and based on that research, they issue the title commitment.

Reviewing the Title Commitment

Homebuyers will be given the title commitment before closing. Just like other documents received from the lender and seller, like disclosures and loan estimates, homebuyers should be sure to do their due diligence by reviewing all these documents and making sure you understand the terms.

Never hesitate to reach out to your real estate agent, lawyer, or title agent for clarification. Make sure that any questions you have are answered in case there are any objections to the stipulations within the commitment. Based on your contract, you may be able to negotiate something that you find unacceptable, but you only have a short period of time to work with the title company to resolve them.

Much like a Loan Estimate reflects what is contained in the final Closing Disclosure, the title commitment will have the same terms, requirements, exceptions, and exclusions that will be in the final insurance policy.

The Basic Parts of an ALTA Title Commitment

Some states don’t use ALTA forms, so what you see may vary in structure. You may see additional sections and the requirements may be listed under a different section.

The Title Commitment is typically divided into two sections:

- Schedule A

- Schedule B, which may be divided further into sections I (Requirements) and II (Exceptions and Exclusions)

Schedule B should be examined with care as it lists what will and will not be covered. Schedule A should be reviewed to ensure there are no discrepancies in the basic information found on other documents like the Purchase Agreement and Closing Disclosure.

Schedule A will usually contain:

- Commitment Date (also known as the effective date)

- Policies to be issued (Lender and/or Homeowner)

- Loan policy information

- Interest in the land (fee simple, leasehold, joint tenancy, etc)

- Current owner(s)

- The legal description

Schedule B section, you’ll find:

Schedule B-I

This section will contain the Requirements, which may sometimes be referred to as the Conditions. Some common requirements are:

- Recording a release

- Payment of taxes

- Terminations of Notices of Commencement or Final Lien Waivers

- Recording the documents securing the new loan

- Recording of mortgage satisfaction and other types of liens

- Transfer of the deed currently encumbering the property

- Recording the new deed

- Estoppel letter if the property is within a community association

- Recording a court order evidencing power of attorney

- Copy of trust, Corporation, or LLC paperwork

- Proof of Identity

Schedule B-II

This section will list all of the exceptions and exclusions that the underwriter will not cover; therefore, the title company will not issue a policy to protect the lender or homeowner from these things.

Some common types of Exceptions are:

- Public utility easements and right of ways

- Mineral and water rights

- Any encroachments, easements, variations in area or content, measurements, party walls or other facts which a correct survey of the property would show

- Assessments by the municipality or association or real estate taxes that are not yet due or payable

- Roads, ways, beds, streams, or easements, if any, not shown of record, and the title to any filled-in lands.

- More exceptions will be detailed in Schedule B.

Some examples of Exclusions:

- Rights of eminent domain, unless recorded

- Any governmental police power, unless recorded

- Any law, ordinance or governmental regulations relating to the use of the property

- Defects, liens, encumbrances or other matters agreed to by the buyer

- Claims arising from bankruptcy or other creditors’ rights laws

Understanding Endorsements, Exceptions, and Exclusions

While most title companies across the country utilize standard forms from the American Land Title Association (ALTA) to issue title policies, not all title commitments are the same. As mentioned before, there are some standard exceptions that may be possible for a buyer and their agent to convince the title company to remove, insure over it with an endorsement, or eliminate the exception by obtaining a release, affidavit, waiver, quitclaim deed or other official documents.

Some underwriters may list additional pieces of due diligence like an updated survey as part of the requirements while others may list boundary issues stemming from outdated surveys as an exception.

Because of these variations, the Schedule B section should be fully understood as well as how endorsements, exceptions, and exclusions will impact the title insurance policy and the protection it provides to the policyholder.

Title Endorsements

In some cases, a buyer may request additional coverage for some exceptions when certain conditions are met, like boundary issues may be removed if a new survey is obtained. An addition to or limitation of title insurance coverage that is attached to a policy is called an endorsement. Endorsements help title agents craft a policy that better suits the needs of the policyholder. These may be available for little or no cost.

How Exceptions impact your property rights

Every title commitment will vary slightly in the exceptions since it relates directly to the property being purchased. There are some standard exceptions that will be commonly found on a title commitment.

When buying in an HOA or community association, the covenants, conditions, and restrictions (CC&R’s) and other deed restrictions will NOT be covered by insurance. These rules may affect how you can use your property. Homebuyers should take great care to understand what the rules of the community are. If they are in conflict with your sensibilities, you may find yourself an unhappy homeowner. Be sure that your Realtor or attorney crafts a contract with the option to withdraw your offer should you find any issues with the association’s rules during the inspection period.

Other exceptions related to properties in an association include “Any loss or damage resulting from a lien or assessment in favor of a homeowner’s association.” ALTA does offer Condominium Endorsements that may be attached to the policy to cover such losses.

Lawsuits pending against an association, like back taxes resulting from undervaluing the units, may also affect future homeowner and will be listed in the exceptions.

Easements and public access laws require homeowners to allow municipal workers and the public to access certain parts of their land. These easements must remain free of encroachments. Such requirements will be noted in the Title Commitment and may affect a homebuyer’s ability to make improvements, like a pool or fence, on the property.

Boundary issues like encroachments and other matter that an updated and accurate survey would disclose may also be listed as an exception. In order to remove it, the title company will typically require a new survey to be purchased.

Learn how to identify easements and encroachments in our Land Survey Webinar Series.

What are exclusions?

Exclusions and exceptions may be used interchangeably depending on your location, but exclusions should be thought of as exceptions that can’t be removed with an endorsement. These are things that are beyond the scope and power of title insurance underwriters because it would conflict with higher authorities or laws. There will always be some rights to your property reserved by the government – taxation, eminent domain, police power, and escheat for example while some current rights like zoning ordinances, building codes, and environmental protection may be altered or removed.

PropLogix is expanding our services for title agents and underwriters. Our Title Searches include all title requirements or conditions to be met to issue a clean policy. With our Preliminary Title Commitment, agents and underwriters receive a holistic list of mortgages, liens, estoppels, taxes, and other defects affecting each property. If you’re interested in learning more, be sure to sign up for updates on this product launch.